Global regulators such as the European Union, United Kingdom, and United States are fast-tracking climate disclosure mandates, and Malaysia is taking firm steps in the same direction.

In September 2024, Malaysia launched the National Sustainability Reporting Framework (NSRF), a major move that aligns local requirements with international best practices.

Under this framework, Scope 3 reporting is no longer optional.

This article outlines Malaysia’s phased approach to climate reporting during this critical period. It’s designed to help business leaders like you understand what’s required, when it starts, and how to prepare.

Overview of the NSRF

Backed by the Securities Commission Malaysia, Bank Negara Malaysia, and Bursa Malaysia, the NSRF adopts guidelines from the International Sustainability Standards Board (ISSB).

It incorporates two key standards: IFRS S1 (General Requirements for Disclosure of Sustainability-related Financial Information) and IFRS S2 (Climate-related Disclosures).

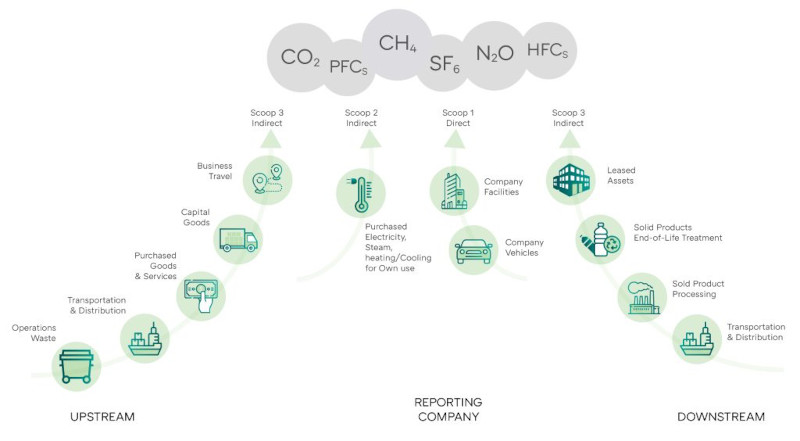

One of the key elements in this framework is the requirement for companies to report their Scope 3 greenhouse gas (GHG) emissions, which include indirect emissions across the entire value chain.

From 2027, many Malaysian businesses particularly those listed on the Main Market will be expected to comply.

Timeline for Scope 3 Emissions Reporting in Malaysia

Malaysia is introducing Scope 3 reporting in phases, based on company type and size:

| Timeline | Applicable Entities |

| 2027 | Main Market public-listed companies (PLCs) with a market value of RM2 billion or more |

| 2028 | Main Market public-listed companies with a market value below RM2 billion |

| 2030 | ACE Market companies and non-listed companies (NLCos) with annual revenue of RM2 billion or more |

Source: National Sustainability Reporting Framework (NSRF)

Previously, under Bursa Malaysia’s Sustainability Reporting Guide, companies only needed to report limited Scope 3 data, such as emissions from business travel or staff commuting.

The NSRF now requires reporting on all relevant upstream and downstream emissions activities.

Further Reading: Ultimate Guide to Sustainability Reporting in Malaysia

Consult Sustainability Experts

Saxon Renewables helps you develop a distinct, compliance-ready roadmap that aligns with your business goals and positions you as a sustainability leader.

Why Does This Matter to Malaysian Companies?

If you are a Malaysian company operating in these regions or working with international investors, aligning with these global reporting standards is more than a regulatory checkbox. It is a way to future-proof your business.

Clear sustainability data:

- builds credibility with stakeholders,

- supports access to capital, and

- creates opportunities to stand out in a competitive global market.

Malaysia’s Effort in the Global Context

Malaysia is not acting alone. Around the world, the momentum for full value chain reporting is growing stronger.

In the European Union, the Corporate Sustainability Reporting Directive (CSRD) will require large companies, including non-EU firms with significant operations in the region to disclose Scope 3 emissions starting in 2025.

Following that, the Corporate Sustainability Due Diligence Directive (CSDDD) will roll out between 2027 and 2029, to align their transition plans with the Paris Agreement, increasing pressure for deeper carbon footprint transparency.

Source: United Nations Framework Convention on Climate Change (UNFCC)

In the United States, California has introduced Senate Bill 253, which starts in 2026. This regulation will make it mandatory for businesses earning over $1 billion in revenue to report Scope 3 emissions, with third-party assurance to ensure accountability.

The United Kingdom began implementing similar standards even earlier. By 2022, companies listed or registered in the UK were already required to disclose climate-related data under the Task Force on Climate-related Financial Disclosures (TCFD).

From 2023, these requirements expanded to more businesses, reinforcing the UK’s shift to adopt International Sustainability Standards Board (ISSB) frameworks.

How This Will Impact Your Business

Over 70% of Business Emissions Come From Scope 3

Scope 3 GHG emissions are indirect emissions that arise from activities outside an organization’s control but are indirectly influenced within its value chain.

Unlike Scope 1 and Scope 2, where

- scope 1 (direct emissions) comes from owned operations and assets, and

- scope 2 (indirect emissions) comes from purchased electricity

Scope 3 encompasses activities that the company does not own but can influence. This can include:

- Upstream activities: Purchased goods and services, fuel and energy-related activities, transportation, and business travel.

- Downstream activities: Use of sold products, end-of-life treatment, waste disposal, and investments.

For many companies, Scope 3 emissions account for 70 to 90% of their total carbon footprint. Addressing these emissions is crucial for any effective emissions reduction strategy.

Further Reading: Why Scope 1, 2, & 3 Carbon Emissions Matter

Regulatory Enforcement Is On the Horizon

While the NSRF currently does not impose penalties for non-compliance, enforcement will soon follow. Updates to the Financial Reporting Act 1997, Companies Act 2016, and Bursa Malaysia’s listing requirements are expected within the next two years.

These legislative changes will empower the Malaysian Accounting Standards Board (MASB) to set national sustainability disclosure standards.

To support businesses in meeting the new requirements, the Advisory Committee on Sustainability Reporting (ACSR) has introduced the Policy, Assumptions, Calculators & Education (PACE) initiative. PACE offers a range of resources, including:

- Training programs

- Calculation tools

- Reporting frameworks like Global Reporting Initiative (GRI)

- Guidance on assumptions and data sources

These tools are especially helpful for small and medium-sized enterprises (SMEs) that may lack internal sustainability teams.

Challenges Your Business Will Face

Reporting Scope 3 emissions is inherently complex due to their indirect nature. A 2024 study by KPMG and the Pacific Basin Economic Council (PBEC) found that only 21% of public-listed companies in Malaysia reported Scope 3 emissions in 2023.

Common challenges include:

- Inconsistent data from suppliers

- Lack of systems to track emissions across operations

- Difficulty standardizing information from different sources

- High cost and time required to complete full reporting

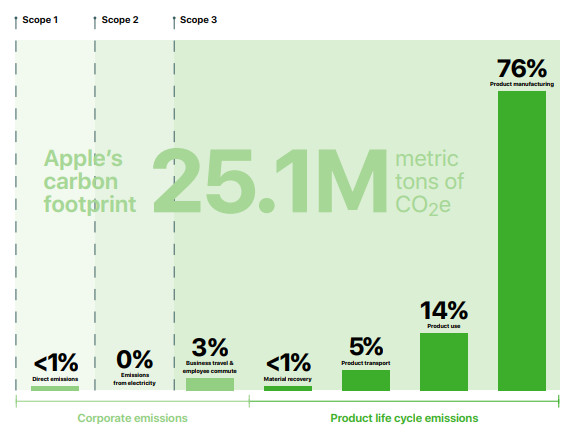

Even major global companies face difficulties. In 2020, Apple emphasized the challenge of reporting scope 3 emissions, as they accounted for over 90% of the company’s total emissions, with 75% coming from supplier manufacturing and 16% from consumer product use.

Scope 3 emissions accounted for 90% of Apple’s 2019 carbon footprint (Source: Apple’s 2020 Environmental Progress Report)

Given the difficulty of tracking emissions across the entire value chain, Apple’s Head of Global Energy and Environmental Policy, Arvin Ganesan, urged the U.S. Securities and Exchange Commission (SEC) in a statement on April 13, 2021, to mandate companies to disclose third party-audited emissions data covering all scopes.

Apple believed that without standardized regulations, companies would struggle to report scope 3 emissions accurately, making climate action more difficult.

How Saxon Renewables Can Help

With over 10 years of experience across more than 8 SEA countries in decarbonization and emissions strategy, Saxon Renewables helps businesses turn climate ambition into measurable results.

Our Climate Transition Plan is aligned with global frameworks like the Science Based Targets initiative (SBTi), guiding you through the complexities of reducing emissions across your operations and value chain.

We support companies at every stage of their sustainability journey, from early-stage planning to implementation and long-term optimization.

Our integrated approach covers data readiness, stakeholder engagement, and compliance with reporting frameworks such as the:

- National Sustainability Reporting Framework (NSRF),

- International Sustainability Standards Board (ISSB), Greenhouse Gas (GHG) Protocol, and

- Task Force on Climate-related Financial Disclosures (TCFD).

We’ve worked with RE100 signatories, CDP participants, and Fortune 500 companies, ensuring they deliver real climate impact responsibly, profitably, and confidently.

Discover how Saxon Renewables can help your business get ahead of NSRF’s mandatory Scope 3 emissions reporting – contact us today!

FAQs

Aireen Tan

Marketing

Aireen bridges sustainability strategy with commercial outcomes. Her work focuses on climate transition planning, renewable energy (PPAs/VPPAs), environmental commodities (RECs and carbon credits), and carbon project development—supporting companies across APAC in navigating complex decarbonization decisions. She is driven by a mission to translate technical climate solutions into business value, contributing toward a world striving for carbon neutrality, climate stability, and global sustainability.